How parental money impacts young people in the UK

It is no secret that many young people receive financial help from their parents. It’s also completely understandable. The average starting UK salary is just £30,000, while the average property price is £281,161 across the country and £529,829 in London.

So, with the costs of living spiralling, we use our skills as behavioural economists to investigate parental support across key areas of young people’s lives.

Areas of financial support

Buying a house

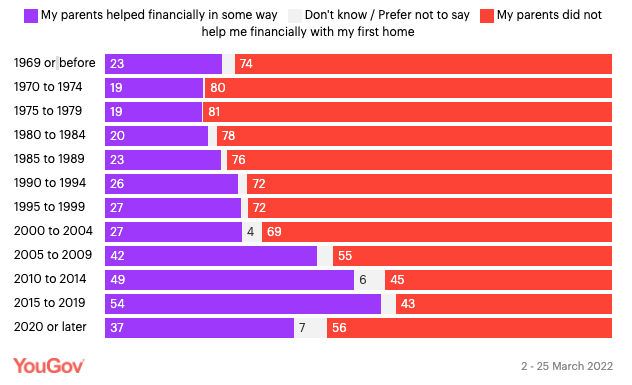

According to YouGov, 54% of people who bought their first home between 2015 and 2019 received support from their parents. This compares to just 27% who purchased their first home between 2000 and 2004. This is also likely to be even higher for people aged 20-30, as the average first time buyer is 34 years old (6 years older than in 2007).

This figure dropped to 37% as a result of the pandemic, yet it’s difficult to see this continuing due to the effects of the cost of living crisis combined with steadily increasing house prices. A young person on the average salary is likely to need to save for around 15 years to afford a deposit.

The impact of this on young people’s sense of achievement is significant. Despite working full time in increasingly unstable jobs, they may never be able to own a home without parental or governmental help. And those that receive parental help are likely to inherit a sense of dependence by continuing to rely on their parents until later life. Socially, they may also face guilt, particularly if many of their friends cannot access similar support.

Even once a deposit is achieved, young people still need to earn approximately £70,000 outside London and £120,000 in London to purchase an average property. This would place them in the top 25% of earners in the UK. Furthermore, even with these salaries, these individuals are unlikely to lead a luxurious life. The average London property is unlikely to be a house, and certainly not one in a prime location.

Saving on rent

Given the picture presented above, it’s perhaps not surprising that a third of young people still live with their parents. And in doing so, they save £600 a month on average compared to renting a one-bedroom flat on their own or £325 if they shared it with a friend.

However, this doesn’t mean that all parents are happy to house their children for free, with approximately a third charging rent. Despite this, the rent paid is usually more than 50% less than the average cost of renting a one-bedroom flat.

The ability to save for a deposit also adds further incentive for young people to remain at home. If, for example, they save £500 a month on rent, they can put an additional £6,000 a year towards a deposit. Yet, this comes at an emotional cost, as they lose many aspects of their independence.

Buying a car

A survey of 2,000 parents in 2019 found that nearly a sixth help their children to buy their first car, contributing on average 45% of the final purchase price. This varied by location, with those in London contributing £4,351 on average. Furthermore, the study showed that more than four out of ten also covered insurance, a quarter covered road tax and a fifth helped towards petrol costs.

With the average cost of owning and running a car £305 a month, the benefits of having this additional family support are considerable. Cars provide independence, status and social mobility, particularly when it comes to finding a job.

Holidays

Approximately 71% of people aged 18-24 holiday with their parents each year, with their parents covering the costs 83% of the time. And this trend continues into later generations, with nearly one in five adults 45-54 holidaying with their folks, with 76% saying that they contributed to the costs.

To highlight the significance of this financial boost, the average cost of a two-week holiday for a family of four in the UK is £4,792. A young person may therefore save over £1,000. This is a useful perk when the average UK salary is unlikely to cover a holiday of this expense.

Considering the implications

We may live in a highly individualistic society, yet the importance of parents in providing financial support through later life is often under-reported. As we’ve shown previously, the average UK salary can barely afford the bare essentials in London. These additional parental perks can therefore dramatically change the quality of young people’s lives.

We hope you enjoyed reading. You may be interested in reading about similar topics. For anything else, please get in touch. We look forward to hearing from you.

Until next time.

Welcome to Posito

We specialise in creative strategy, content creation and brand creation.